SAP Business One Fixed Assets and how it helps businesses streamline key assets management functions

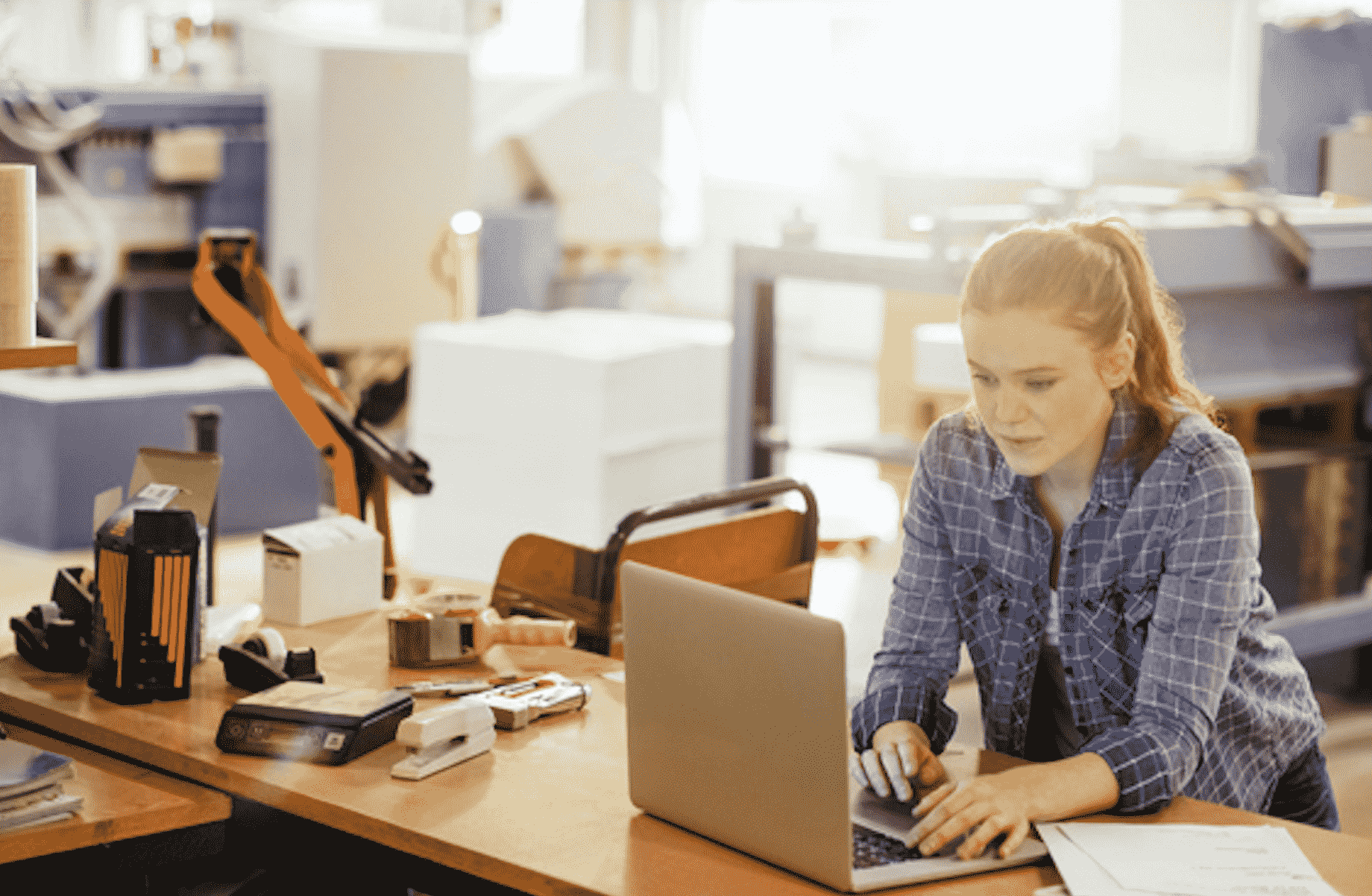

First of all, the Fixed Assets Register can sometimes be a neglected area of a business.

Over the last 12 years, we have seen many businesses outsourcing the maintenance of the Fixed Asset Register to their external accountants or running it on a template spreadsheet.

However, both of these options require manual human intervention for data to be updated and refreshed regularly. And so, the question: Is this the best way to manage Fixed Assets?

In addition, if the Fixed Assets management process is not integrated seamlessly into the core financial system of your business, data entry, manual processes and unnecessary risk can cause headaches.

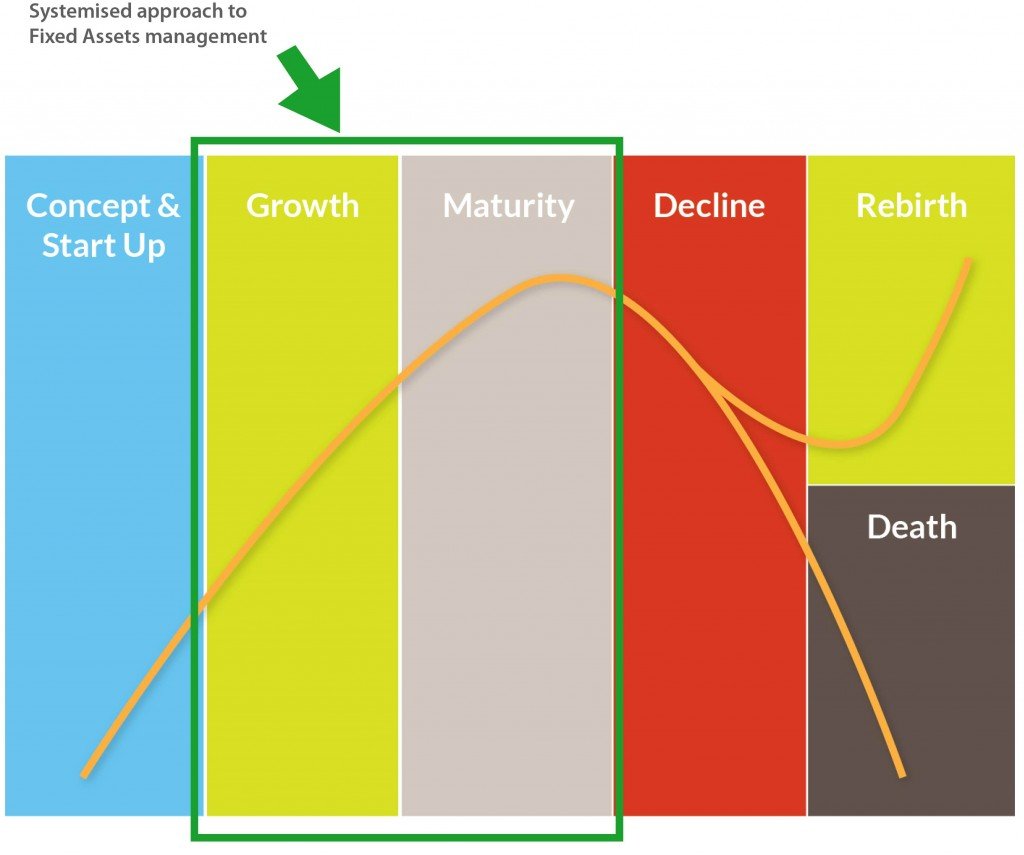

This is still manageable when your business is in a “start-up” mode or has limited requirements but when the expansion is imminent, a systemised approach becomes necessary.

How to Systemise Your Organisation’s Fixed Assets Management

If a business is going through a period of expansion as a result of an aggressive strategy or organically, it will generally be looking at capital expenditure to ensure the growth is sustainable.

New assets to increase production or to develop new product lines are a couple of examples to drive growth but whatever the motives might be and regardless of industry or region, capital expenditure is a necessary area of a business and shouldn’t be managed separately to the operational system.

SAP Business One Fixed Assets module

SAP Business One has a comprehensive Fixed Asset module which allows the financial lifecycle of an asset to be captured and maintained from acquisition to retirement.

The suite of features available within the Fixed Asset module is complimented by other modules such as Finance, Purchasing, Sales, Cost Accounting and Projects which can be configured for a seamless end-to-end workflow across departments.

What does this mean to you?

SAP Business One will integrate departments so that the asset acquisition lifecycle is centralised, templated and systematic. This approach will ensure the right results are delivered time and time again with minimal manual intervention.

Workflows are highly configurable and designed around your business’ needs.

In the past 12 years, we have configured SAP Business One Fixed Assets for many Australian organisations of various industries and sizes. Here are some examples of the most common benefits SAP Business One Fixed Assets brings to expanding businesses from our experience:

- When a Purchase Requisition for a fixed asset over $25,000 will trigger an approval procedure to management;

- When a supplier’s invoice is posted for a fixed asset SAP Business One will automatically capitalise and starts depreciation on the date of invoice;

- When posting the depreciation run, the expense needs to be distributed over many departments and/or projects;

- While the asset is under construction the depreciation start date needs to be delayed until all costs are received;

- Depreciation is calculated on measurement readings and expensed over and above ordinary depreciation;

These scenarios are some of the key areas where SAP Business One Fixed Assets can help organisations scale and fuel organic growth. These scenarios and more are easily handled by the SAP Business One Fixed Assets module, streamlining the Fixed Asset management process.

More Functionalities available in the SAP Business One Fixed Assets module

Depreciation Calculation: The calculation used to determine the depreciation expense posted into the financial period. Monthly or Daily calculation rules available.

Depreciation Areas: A Depreciation Area is a financial dimension showing the valuation of the asset according to a particular accounting standard. Book depreciation, tax depreciation or depreciation for cost accounting are examples of depreciation areas.

Depreciation Types: The Depreciation Type classifies the depreciation based on the reason for the value adjustment. Straight line, declining balance, multi-level and immediate write-off are examples of depreciation types.

Account Determination: The Account Determination definition enables the system to automatically select the relevant G/L accounts for assets accounting. Balance sheet and Profit & Loss account for acquisitions, depreciation expense and accumulation, retirements and revenue are examples of account determination.

Asset Class: The asset class is the grouped combination of depreciation area, depreciation type and account determination that is assigned to the fixed asset. It is also where low-value assets are determined.

Attribute Groups: Attribute groups is a set of fields that can be configured based on the nature of the assets. An example of an attribute group for a vehicle could be license plate, registration expiry, next service, warranty period, towing capacity and the insurance company.

There many reasons why we have been SAP Business One Partners for 12 years. The SAP Enterprise Resource Planning solution is highly customisable to help businesses streamline various areas, increase productivity and scale!

But most important, SMEs love this ERP because it centralises the management of all the aspects of a business from Accounting & Finance to Marketing & Sales, Operations and more. This is why 55,000 companies in 150 countries already use and trust SAP Business One.

Conclusion

If your organisation is going through a period of expansion as a result of an aggressive strategy or organically, an ERP system can help you streamline your approach by capturing all of your business information in a single, scalable system.

Fixed Assets is a key area where SAP Business One can make a significant impact and help your organisation eliminate manual data entry, reduce error and increase accuracy.

Keep in mind, SAP Business One is already used by more than 55,000 companies around the globe to manage multiple aspects of their businesses.

What challenges do you face in the management of your Fixed Assets? Let us know in the comment below!

Leave A Comment