A guide to better Fixed Asset Management with SAP Business One

Let’s explore the Fixed Asset Management module in SAP Business One and how it can help you automate the management of your business’ fixed assets while incorporating all relevant data into reporting and decision-making.

Do you want to boost income on your profit and loss statement, increase the value of your company, and streamline capital expenditure to support growth?

A key factor in achieving these outcomes, that finance managers may be overlooking, is how you monitor and manage fixed assets.

In the past, fixed asset accounting has been treated like the proverbial poor cousin. But managing asset acquisition and value effectively over time is an important facet of maximising your business’ financial wellbeing.

SAP Business One includes a Fixed Asset Management module that simplifies fixed asset accounting to help CFOs get the most from assets and incorporate all relevant data into their reporting and decision-making.

Why does integrated fixed asset management matter?

Typically, small to medium enterprises have kept an asset register in a simple spreadsheet or similar, with asset depreciation and capitalisation relegated to an end-of-month task, handled separately. Some templates for basic fixed assets management can even be found online for free. But is this the best solution?

Microsoft offers Excel Templates for basic fixed assets management and tracking

As your business grows in size and complexity and capital expenditure becomes more critical to enabling your operation to scale—it pays to keep a closer eye on assets and how they influence your bottom line, investor appeal, and overall business value.

Finance leaders report that manual tasks and intensive reporting processes are still the biggest bottleneck in financial close and accounting operations, making it harder for CFOs to focus on offering more strategic business advice.

SAP Business One makes finance automation a breeze, with integrated capabilities that virtually eliminate repetitive, manual data entry around fixed assets.

Fixed Asset Management in SAP Business One

SAP is an innovative company with ambitious development plans to ensure small to medium businesses can access fully-featured software that will grow with them. If you implement SAP Business One for financial management, fixed assets are then visible within the same, comprehensive system you use to manage all financial data.

You can easily import fixed asset master data and establish clear workflows. That means no more manual journals to recognise asset information sitting in another system.

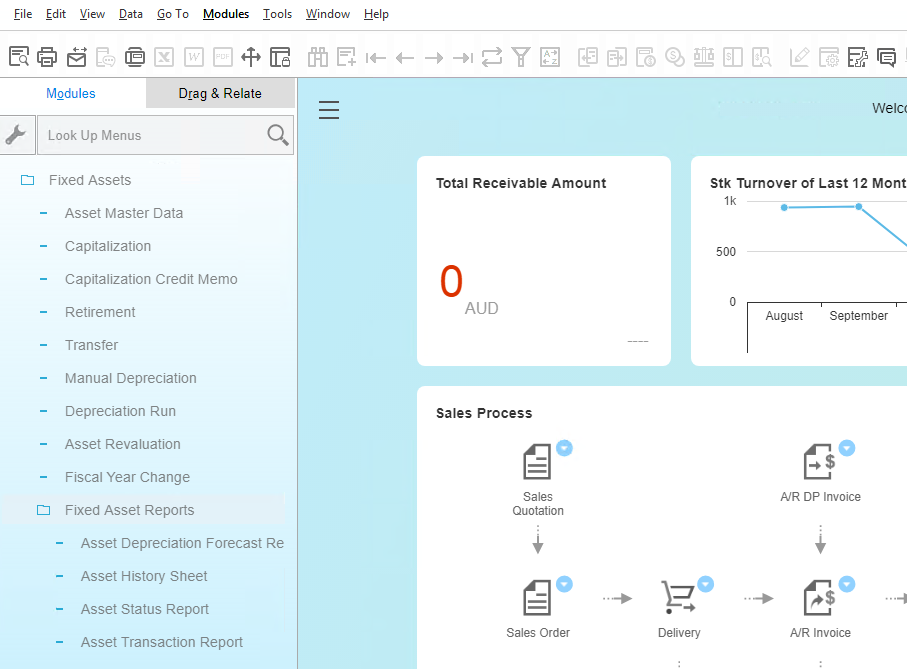

Fixed Assets Management Module Overview in SAP Business One

Fixed Asset Management features in SAP Business One enable you to:

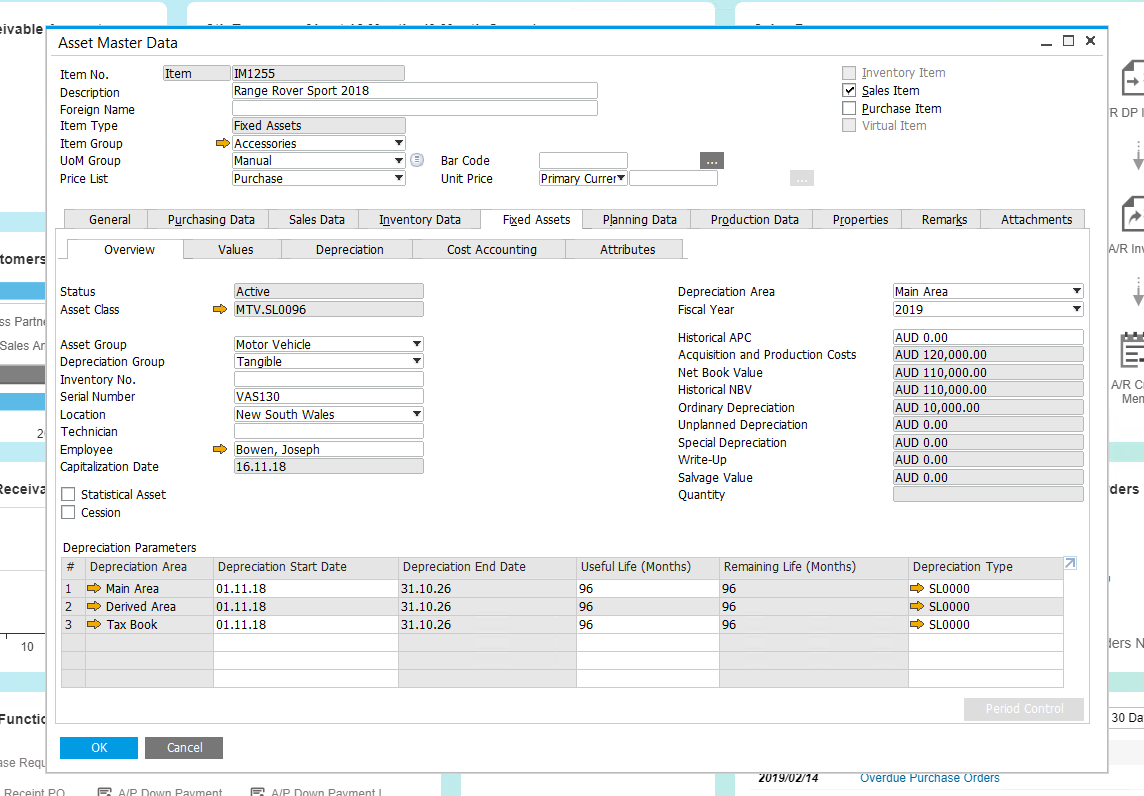

- Assign and track different attributes for specific assets, and define asset classes across your business.

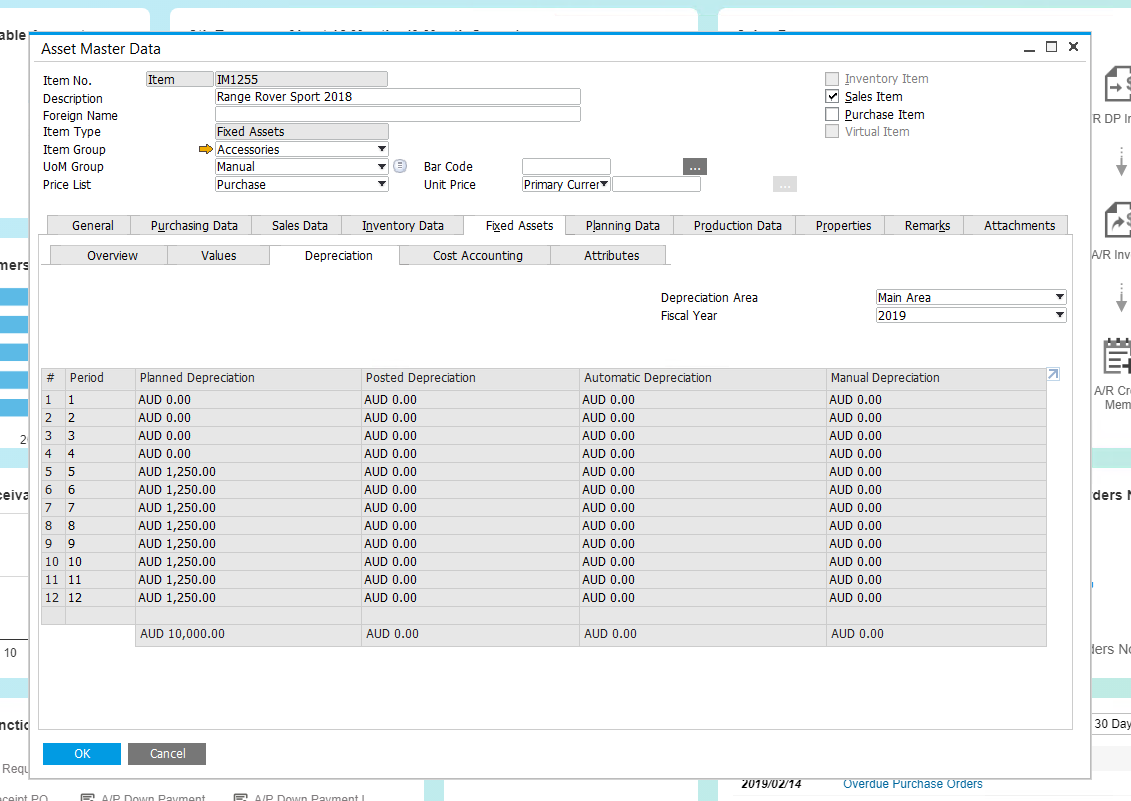

- Automate depreciation runs using various depreciation methods, with monthly or daily calculation rules available.

- Allocate a ‘depreciation area’ that indicates the valuation of an asset according to a particular accounting standard, such as book depreciation, tax depreciation or depreciation for cost accounting.

- Define accounts for specific asset calculations: the system then automatically selects the relevant G/L accounts for fixed assets accounting.

- Tie asset acquisition processes into procurement, with automated workflows that simplify the sale and disposal of assets.

- Forecast what your depreciation will be for the year ahead at the start of a new financial year.

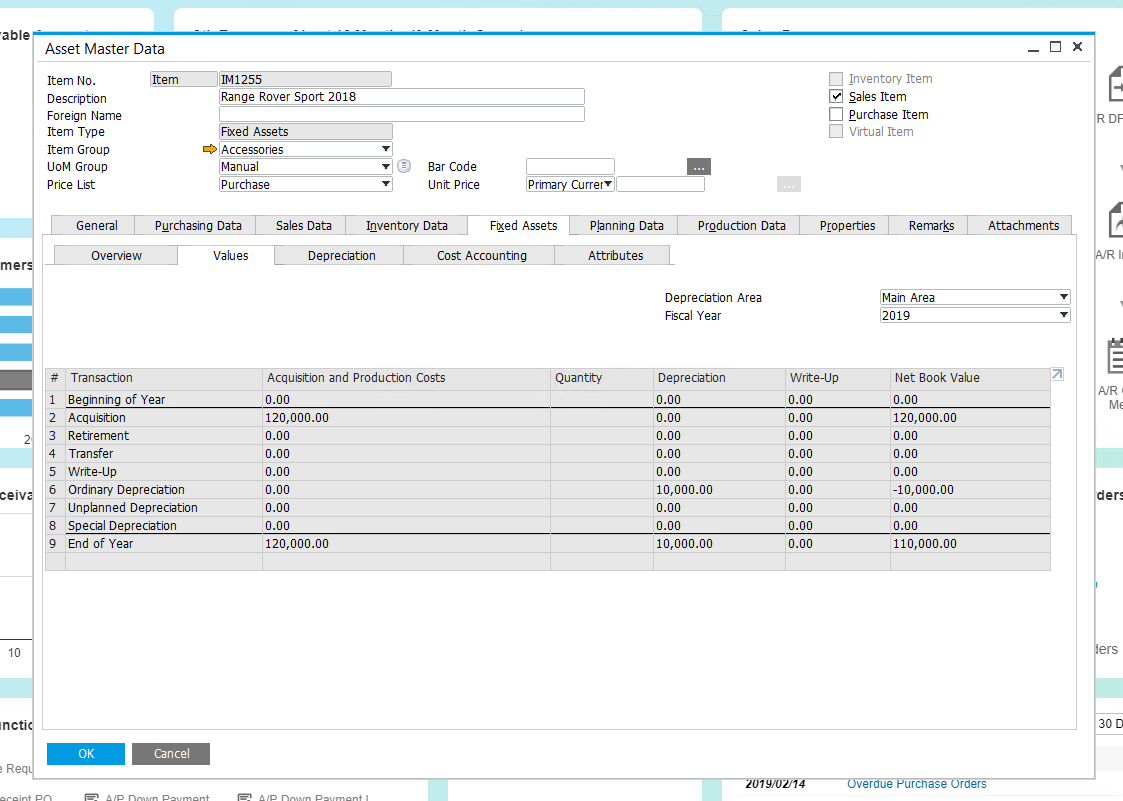

Values in SAP Business One fixed assets

Depreciation schedule in SAP Business One Fixed Assets

Streamline fixed asset acquisition, disposal and re-allocation

Where SAP Business One really shines in terms of fixed asset management is streamlining the acquisition of assets. Let’s say one of your sales reps needs a new computer:

- They create a purchase requisition in SAP Business One, and once purchased the capitalisation occurs immediately and automatically.

- The purchasing ledger and asset register are instantly reconciled and display the correct values without manual finance team intervention.

- The general ledger determination for acquisition and future depreciation is done automatically.

- Because the correct financial postings for depreciation of the asset can be set-up easily, the ongoing postings and depreciation calculations are also automated when the asset is sold or disposed of in future.

The flexibility to apply financial dimensions to your chart of accounts in SAP Business One combined with asset management functionality makes it easy to reallocate assets to different divisions within your business.

Creating Fixed Assets reports in SAP Business One

So if our hypothetical sales rep resigns, and the asset (his computer) will now be used by the marketing manager, you can simply move the depreciation to the marketing team within your accounts. It’s rarely straightforward for an accountant to do the same when fixed asset management is done via a separate system.

Include assets and achieve more

How can you expect to gain a complete picture of your company’s financial health if you can’t quickly and accurately account for the value of property, plant, vehicles and hardware that keep your business expansion plans on track, your factories running, and your workforce productive?

Savvy finance managers at the forefront of driving digital transformation within their company choose SAP Business One to integrate all data that affect operations, so they can see and optimise assets day-to-day as part of broader financial management and reporting.

Keen to see SAP Business One in action for improved financial management that incorporates fixed assets? Speak with one of our consultants today.

Good article James, the taxation gain by accurately claiming depreciation on assets alone would more than make it worthwhile to pay to accurately track fixed assets.

“Thanks for the information!! “